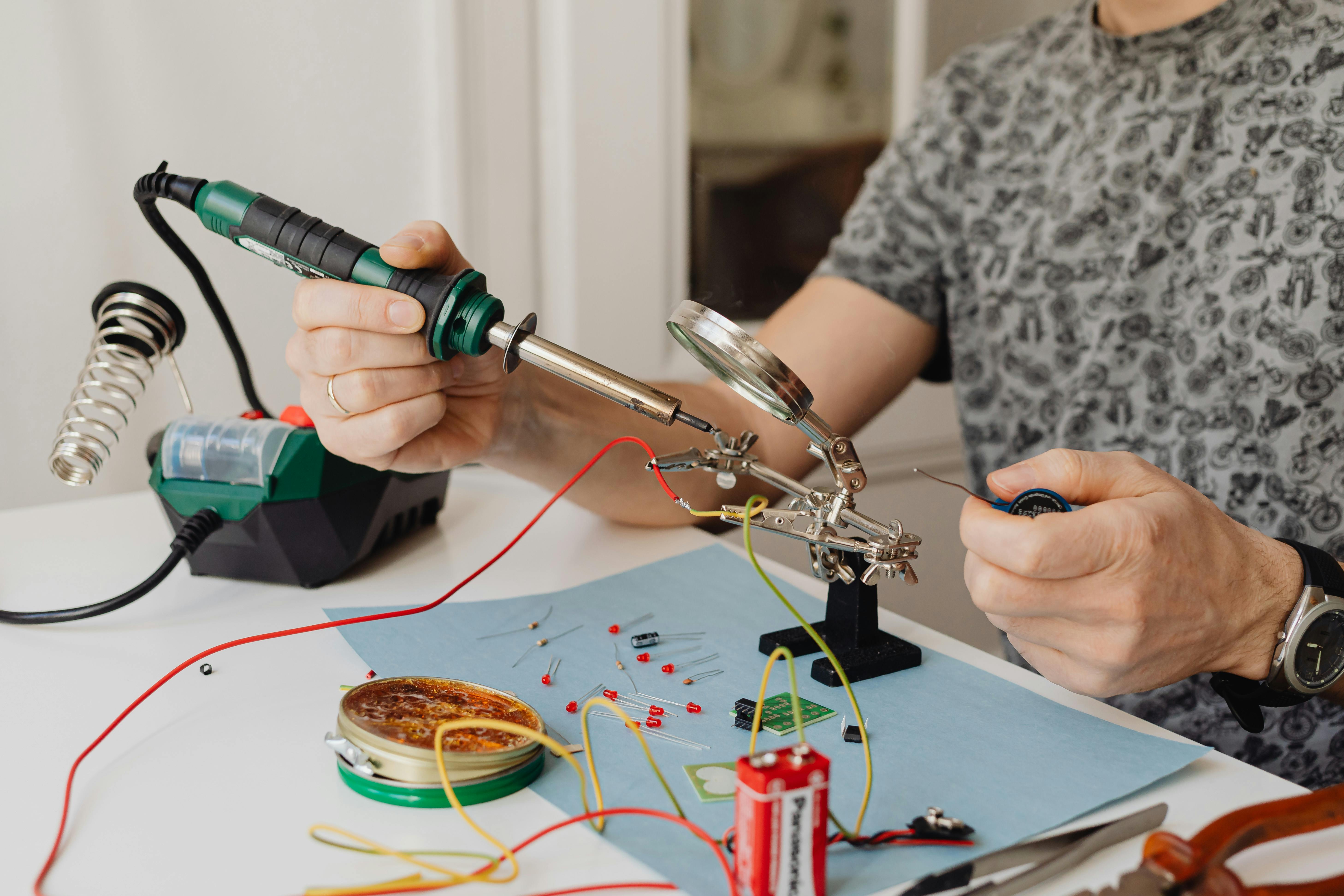

The Fragile Core of Electronics

Q1. Could you start by giving us a brief overview of your professional background, particularly focusing on your expertise in the industry?

My leadership was most deeply shaped during my tenure as CEO of Elin Electronics, where every decision carried immediate consequences for employees, partners, and shareholders. Guiding the company through transformation and operational expansion taught me the importance of balancing strategic vision with day-to-day execution, and of communicating with clarity and empathy during times of change. Earlier, as Vice President at Dixon Technologies, I managed large-scale operations and global partnerships. Accountability here meant ensuring efficiency at scale while nurturing trust with clients. It reinforced that operational discipline and stakeholder relationships are inseparable.

Today, as an operations consultant and advisor, accountability has taken on a new dimension—owning my voice, sharing generational wisdom, and modelling reinvention. These roles remind me that leadership is not only about guiding companies, but also about inspiring people to embrace alignment and authentic growth.

Q2. What is the one structural shift in the EMS/OEM landscape that is materially changing customer decision-making today—and why does it matter now versus two years ago?

The most significant structural shift in the EMS/OEM landscape today is the move from cost-centric outsourcing to resilience- and capability-centric partnerships. Two years ago, customer decisions were still primarily driven by price efficiency and speed to market. Today, the conversation has changed customers are prioritising supply chain resilience, sustainability, and access to innovation alongside cost.

• Resilience: Post-pandemic disruptions and geopolitical tensions have made customers wary of single-region dependence. They now seek diversified manufacturing footprints and partners who can guarantee continuity.

• Sustainability: ESG compliance has moved from a “good-to-have” to a “must-have.” Customers want partners who can deliver green manufacturing and transparent practices.

• Capability Access: OEMs and EMS providers are no longer just execution arms—they are expected to bring design input, digital integration, and advanced manufacturing expertise.

Why it matters now versus two years ago:

Two years ago, cost arbitrage was still the dominant driver. Today, customers realise that the cheapest option can be the most fragile. The shift is material because it changes the criteria for decision-making: from “Who can make it cheapest?” to “Who can help us stay resilient, compliant, and innovative in a volatile world?”

Reflection:

As someone who has led operational transitions and now advises on strategic reinvention, I see this shift redefining the EMS/OEM relationship. It is no longer transactional—it is collaborative, shaping not just products but the long-term identity of the customer’s brand.

Q3. Where has automation, Industry 4.0, or AI materially improved yield, cost, or speed in EMS—and where has technology failed to deliver ROI despite heavy investment?

Automation, Industry 4.0, and AI have materially improved outcomes in EMS by directly addressing repeatable, high-volume processes. For example:

• Yield & Quality: Automated optical inspection (AOI) and AI-driven defect detection have significantly reduced error rates in PCB assembly, improving yields and lowering rework costs.

• Speed: Smart factories that use predictive maintenance and real-time analytics have reduced downtime, accelerating throughput.

• Cost Efficiency: Robotics in assembly and packaging has lowered labour costs while ensuring consistency at scale.

Example – Success:

At a large EMS plant in Noida, AI-driven predictive maintenance reduced machine downtime by 30%. The plant manager recalls: “We stopped reacting to breakdowns and started preventing them. That alone paid for the investment.”

Where technology has struggled to deliver ROI is in areas where complexity outweighs scale:

• Over-automation: Heavy investment in robotics for low-volume, highly customised products often fails to justify costs.

• AI in Supply Chain Forecasting: Despite big promises, many EMS firms found AI models unreliable when faced with pandemic-level disruptions or volatile demand.

• Integration Challenges: Legacy systems and fragmented data often limit the effectiveness of Industry 4.0 platforms, leading to underutilised investments.

Example – Failure:

A mid-sized EMS firm invested heavily in end-to-end AI supply chain forecasting. When COVID hit, the models collapsed under unpredictable demand swings. The CFO admitted: “We spent millions, but the system couldn’t see what human judgment did.”

Reflection:

The lesson is clear: technology delivers ROI when aligned with scale, repeatability, and data quality. It fails when applied indiscriminately or without integration into human decision-making. Leaders must treat automation and AI not as silver bullets, but as strategic tools that complement human judgment and operational context.

Q4. Which geography or customer segment looks attractive in growth data but is operationally the hardest to scale profitably—and what typically breaks first?

One of the most attractive yet operationally challenging segments today is emerging-market consumer electronics, particularly in geographies like India and parts of Southeast Asia. Growth data looks compelling: rising middle-class demand, smartphone penetration, and government incentives. Yet scaling profitably in these regions is far harder than the numbers suggest.

Why it’s attractive:

• Explosive demand for affordable electronics and appliances.

• Government policies (PLI in India, tax incentives in Vietnam) are encouraging local manufacturing.

• Global brands are eager to capture market share.

Why it’s hard to scale profitably:

• Price Sensitivity: Customers demand low-cost products, squeezing margins.

• Fragmented Supply Chains: Infrastructure gaps and logistics bottlenecks increase costs.

• Talent & Skill Gaps: Advanced automation requires skilled labour, which is unevenly available.

• Regulatory Complexity: Compliance with local policies and ESG standards adds overhead.

What typically breaks first:

• Margins: Price wars erode profitability faster than expected.

• Supply Chain Reliability: Logistics and vendor quality control often falter under rapid scaling.

• Execution Discipline: Companies underestimate the operational rigour needed to balance cost, quality, and speed in volatile markets.

Example – Smartphones in India:

A global smartphone brand entered India with aggressive growth targets. Sales soared, but profitability lagged. Logistics costs, warranty claims, and razor-thin margins broke the model. The company eventually shifted strategy—focusing on premium segments and local partnerships rather than solely chasing volume.

Reflection:

The lesson is that growth data can be seductive, but scaling profitably requires discipline and realism. Leaders must look beyond demand curves to ask: What will break first if we chase growth too fast? Only then can they design strategies that balance ambition with resilience.

Q5. How do ESG and compliance demands begin to pressure growth or margins, and how do strong operators balance this trade-off?

ESG and compliance demands begin to pressure growth and margins by adding new layers of cost, complexity, and accountability to operations. What once was a secondary consideration—environmental impact, labor practices, and transparency in governance—has now become a primary filter for customers, investors, and regulators.

• Cost Pressure: Green manufacturing, renewable energy adoption, and waste management require upfront investment.

• Operational Complexity: Compliance audits, certifications, and reporting slow down speed-to-market.

• Margin Impact: Customers still expect competitive pricing, but ESG requirements raise the baseline cost of doing business.

Example – Textiles in South India:

A textile exporter once struggled when European buyers demanded water recycling and carbon footprint disclosures. Margins dipped initially, but over time, compliance became a differentiator. The owner reflected: “We lost money at first, but then we won contracts others couldn’t qualify for.”

How strong operators balance the trade-off:

• Embed ESG into Strategy: Treat sustainability as core, not compliance.

• Leverage Efficiency Gains: Energy savings, waste reduction, and automation often offset costs.

• Use ESG as a Differentiator: Strong operators turn compliance into a competitive advantage, winning contracts and earning investor trust.

• Transparent Communication: They explain to stakeholders why short-term margin pressure leads to long-term resilience and brand equity.

Reflection:

The fundamental shift is in mindset. Weak operators see ESG as a burden; strong operators see it as an investment in resilience, reputation, and future growth. The trade-off is balanced by reframing ESG not as cost, but as currency for trust and long-term competitiveness.

Q6. Which part of the electronics value chain feels most fragile today, and what signals indicate stress early?

The most fragile part of the electronics value chain today is the semiconductor and critical component supply chain. Chips, batteries, and specialised sensors are the lifeblood of modern electronics, yet they remain highly concentrated in a few geographies and vulnerable to disruption.

Why does it feel fragile:

• Geographic Concentration: Semiconductor fabs are clustered in East Asia, making them exposed to geopolitical risk.

• Long Lead Times: Chip production cycles are measured in months, not weeks, leaving little flexibility.

• Capital Intensity: Building new fabs requires billions of dollars and years of investment, slowing diversification.

• Demand Volatility: Surges in EVs, smartphones, and AI hardware create bottlenecks that ripple across industries.

Early signals of stress:

• Lead Time Extensions: When component delivery times stretch beyond 12–16 weeks, it’s a clear warning.

• Inventory Imbalances: Either excess stock at distributors or sudden shortages at OEMs signal volatility.

• Price Spikes: Rapid increases in chip or battery prices often precede broader supply chain stress.

• Customer Behaviour: When large OEMs begin double-booking orders or hoarding inventory, it indicates fear of disruption.

Example – Automotive Sector:

In 2021, automakers faced chip shortages that halted production lines. The first signal wasn’t factory shutdowns, it was suppliers quietly extending lead times from 8 weeks to 20. By the time OEMs reacted, assembly plants were already idling.

Reflection:

The lesson is that fragility shows up first in small signals—longer lead times, unusual pricing, or sudden customer behaviours. Strong operators don’t wait for crises; they monitor these signals and diversify early. In today’s electronics landscape, resilience is built not in response to disruption, but in anticipation of it.

Q7. If you were allocating capital today, what question would you ask management that most investors overlook, and what kind of answer would make you uneasy?

If I were allocating capital today, the one question I would ask management is:

“How resilient is your supply chain and operating model under stress and what specific signals do you monitor to act early?”

Most investors focus on growth projections, margin profiles, or market share. What they often overlook is the operational resilience that determines whether those numbers hold up when disruptions hit. In today’s environment, geopolitical tensions, ESG compliance, and technology shifts, resilience is not a side issue; it is the foundation of sustainable returns.

What would make me uneasy:

• Vague answers: If management speaks in generalities like “we have strong suppliers” without clear metrics or contingency plans.

• Overconfidence: When leaders dismiss risks as unlikely rather than showing how they prepare for them.

• Lack of transparency: If they cannot articulate early warning signals such as lead time extensions, inventory imbalances, or regulatory shifts that they track to stay ahead.

Reflection:

Strong operators balance ambition with realism. They acknowledge fragility, invest in resilience, and communicate transparently. Weak operators chase growth curves without preparing for stress. As an investor and leader, I would be uneasy with any answer that suggests growth without resilience because in today’s world, resilience is growth.

Comments

No comments yet. Be the first to comment!