Why Aluminium’s Stakes Are Rising

Q1. Could you start by giving us a brief overview of your professional background, particularly focusing on your expertise in the industry?

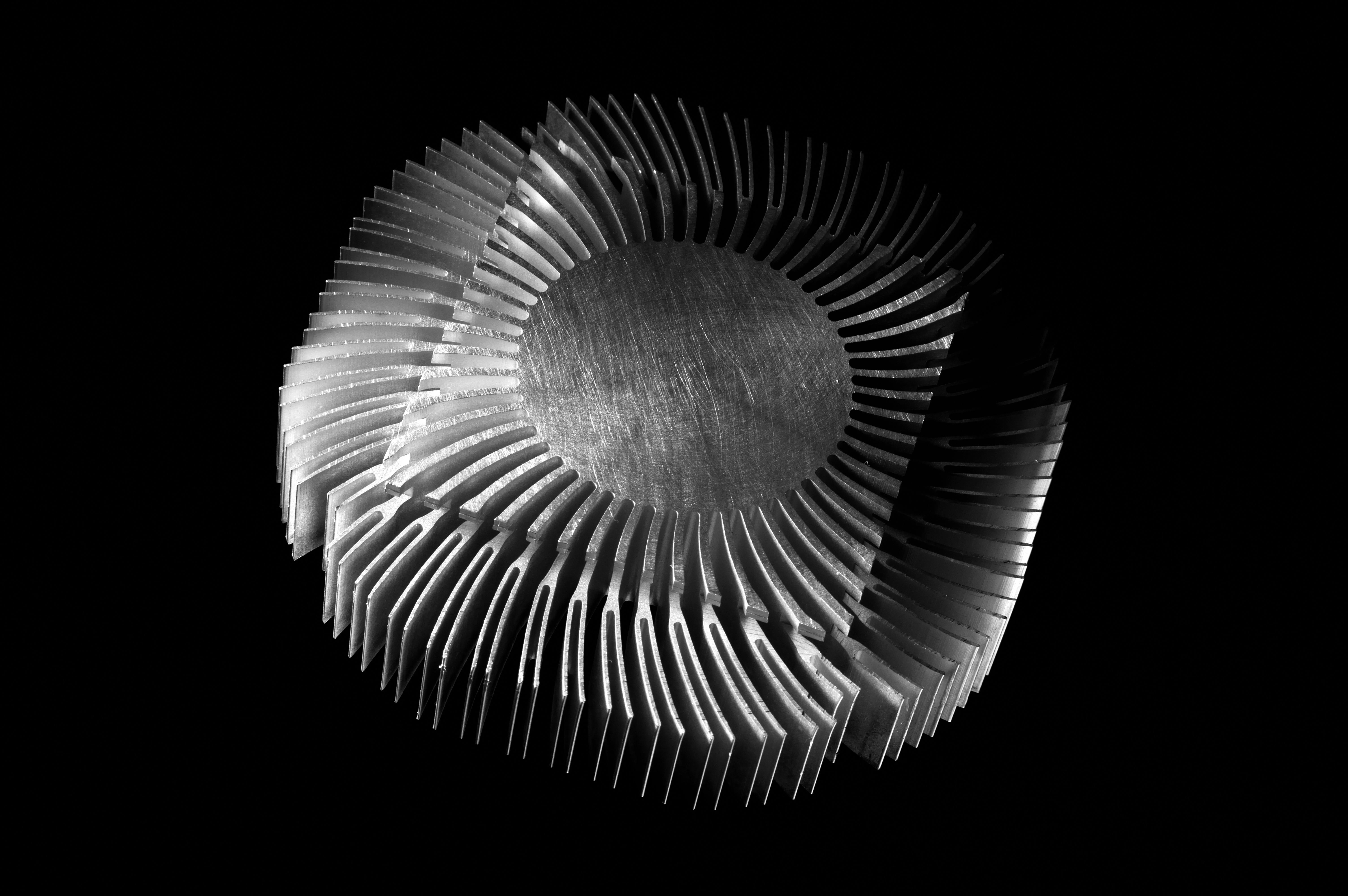

I am a metallurgist with 40 years of experience in aluminium casting, rolling, extrusion, and the production of aluminium master alloys. I have developed many unique products and processes. I am a key player in the production of BrahMos missiles, ISRO's PSLV and GSLV satellites, and other systems. I have produced hard aluminium alloys for the Indian Army and Navy. In my last 20 years of career, I have mainly worked as a CEO/COO/Business Head to turn around industries.

Q2. How quickly is demand shifting toward low-carbon or green aluminium, and which customer segments are leading this change?

Everybody wants to produce liquid aluminium at the lowest cost possible. Low-carbon or green aluminium is only technical jargon. People buy scrap, remelt it without electricity, and claim to have produced green aluminium. Practically, this has been done for more than 100 years now; it is nothing new.

Q3. Where has AI delivered measurable operational impact in aluminium operations—and where has it failed to move the needle?

AI can be of great help in the aluminium industry, especially in the Potroom, where there are thousands of pots, each behaving like a separate child. But I am an expert of aluminium casting, rolling and extrusion. In these fields, it has to be explored how much AI can be used. I have yet to experience AI in aluminium plants.

Q4. What opportunity in aluminium looks small today but could become strategically critical in 3–5 years?

Aerospace and Defence. In 3-5 years, India will become a global supplier of aerospace and defence products, including missiles and drones. There is an unlimited market for these items worldwide, given the many wars underway. I am an expert in this field, and I see a glorious future in this field.

Q5. What purchasing flexibility do customers expect today that would have been unacceptable five years ago?

Customers now expect a performance guarantee on aluminium products that includes consequential damages, not just cashback. For example, if one buys a parachute and it does not work, the customer will not be satisfied with a money-back guarantee.

Q6. From your vantage point, how has the aluminium competitive landscape evolved over the last two years?

I do not see a significant change in the last two years. Either it was an Indian or a Chinese source. But with so many countries signing FTAs, quality competition may soon be fierce.

Q7. If you were an investor looking at companies within the space, what critical question would you pose to their senior management?

Are you ready to invest in aerospace and defence, where the market and profit are both unlimited?

Comments

No comments yet. Be the first to comment!