The Art and Impact of Pricing

Pricing is the litmus test of every company.

A company can offer the best qualitative product or service with excellent packaging and promotion, but if the price is not right, the company will sell next to nothing.

It is common knowledge that 90% of all product ideas and innovations fail with a resulting “product graveyard” where probably half of the products simply have been poorly priced.

Significance of Pricing

Setting the “right” price for any product or service is always a balancing act. A lower price is not necessarily always ideal, as the product might see a healthy stream of sales without turning any profit. Conversely, a high price might hinder budget-conscious customers from buying at all. In the end, pricing is seen as placing a value on a business’s product or service.

Factors that Influence Pricing

Ultimately, however small or large, every business must find and develop the right pricing strategy for its products and goals. Companies must consider internal factors like:

- Production costs

- Logistic costs

- Revenue goals

- Margin goals

But even more important are often external factors such as:

- Inflation

- Consumer trends

- Image

- Awareness

- Competitor prices

- Supply shortages

- Consumer perceptions

But even if a company had full information on all these factors, setting a price for a new or existing product line is not just pure math.

May the windfall profits of the last years have made companies “lazy” as prices seemed only to have gone up? This time has come to an end in many industries already.

As there are many different pricing approaches – e.g., competitor-based, value-based, cost plus, or dynamic pricing – selecting the right one for your business and situation is paramount. Thus, a systematic and comprehensive pricing approach is much more needed today.

Frequently Asked Questions

1. How has the pandemic affected pricing strategies for businesses?

For many companies, the pandemic was a “winner” as companies could increase prices blaming higher costs, sourcing, and supply chain issues. So, for two years, many companies reaped windfall profits. Most companies, however, are still missing a solid pricing strategy, and the inactive and reactive behavior of the last two years now backfires in many industries.

In short, the pandemic covered some shortcomings in pricing.

2. How can businesses balance the need for profitability with affordability in pricing?

This ever-ongoing game between producers and customers oscillates in both directions. A good example might be the milk business. If one compares traditional cow milk to the pseudo-new and vegan oat, soja, and almond milk, it is observable that the latter kinds of milk are much more expensive. This cannot be argued by production and logistic costs but is just an exploitation of customers' willingness to pay for vegan and organic food. But a good example for pursuing profitability in pricing.

3. What are some common pricing mistakes that businesses make during economic uncertainty?

The typical mistake is a reflexive price cutting. Especially when times are hard, almost all businesses react with discounts and price cuts to increase volume and drive sales up again. This strategy almost always backfires later and is very often not even successful in the short term.

The second mistake is the lawnmower approach. Almost every company has successful products and services and not-so-successful ones. A sound analysis of the profitable products, customers, orders, and so on in comparison to the outlook and future of these is often missing.

4. How can businesses use data analytics to make better pricing decisions?

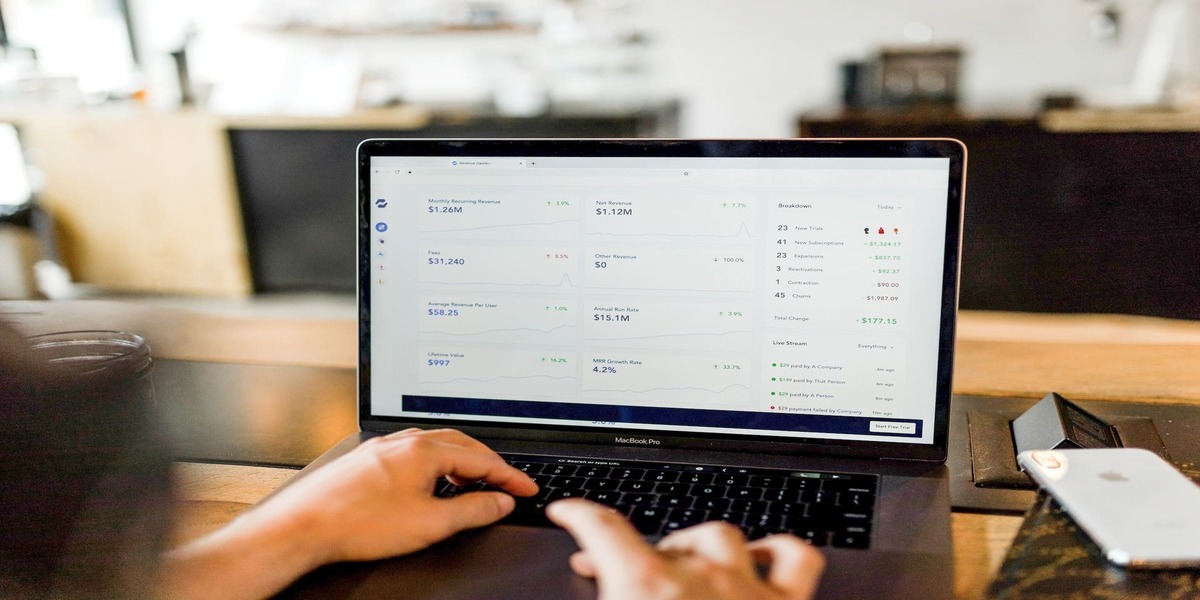

Big data, and especially usage data, is the key to better pricing. Companies with excellent data may engage in dynamic pricing, react faster to external trends, and exploit customers’ willingness to pay better. As such, these companies typically have a 2-5%-points higher EBITDA than the others.

Comments

No comments yet. Be the first to comment!