Energy Storage in Belgium & Europe

Q1. Could you start by giving us a brief overview of your professional background, particularly focusing on your expertise in the industry?

I am an energy storage consultant based in Antwerp, Belgium, with decades of hands-on experience in battery technology and energy management. Growing up in a family-run battery business founded in 1981, I built deep expertise in energy storage, conversion, and management. Over my career, I have helped customers design and manufacture battery systems for various applications, translating technical innovations into practical energy solutions.

This blend of industrial heritage and modern consultancy puts me at the nexus of tradition and innovation in energy storage. I have witnessed the progression from legacy lead-acid batteries to today’s high-performance lithium-ion systems and emerging technologies like sodium-ion and solid-state batteries.

Q2. What is the projected growth rate of Belgium’s energy storage market through 2030, and how does it compare to broader European market trends?

Belgium’s energy storage market is experiencing rapid growth, outpacing many of its European counterparts. System operator Elia’s capacity auctions have contracted 1.1 GW of new battery storage to be in place by 2028-2029. Industry analysis indicates that over 2 GW of battery projects are being developed. By 2030, Belgium’s total installed storage capacity is projected to reach roughly 3–4 GW, implying a compound annual growth rate of 30%, positioning Belgium as one of Europe’s fastest-growing storage markets.

Europe as a whole shows strong growth, though with variations across countries. Much of Europe’s storage expansion is driven by behind-the-meter installations: residential batteries are expected to remain the largest source of demand, led by Germany and Italy, followed by markets like Austria, Switzerland, Belgium, Sweden, Spain, and the UK.

The aggressive growth of Belgium’s energy storage capacity is fueled by policy support and market opportunity. Belgium benefits from a favorable regulatory regime for storage, and lucrative balancing markets make battery investments financially attractive. Broadly, Europe’s energy storage deployment is on a robust upward trajectory as renewable energy penetration rises, but Belgium’s growth rate suggests it is leveraging its specific market design and policy tools effectively.

Q3. How are major industry players like GIGA Storage Belgium, TotalEnergies, and ABEE positioning themselves for long-term success?

GIGA Storage Belgium

GIGA Storage is constructing the Green Turtle battery park in Dilsen-Stokkem, a 700 MW / 2,800 MWh installation. Strategically located adjacent to Elia's new 380 kV substation, the battery park will directly reinforce the high-voltage grid. GIGA Storage’s ambition extends beyond this single project to achieve 5 GW of installed storage capacity by 2030.

TotalEnergies

TotalEnergies is actively expanding into the battery storage sector as part of its transition from oil & gas into renewables. It is investing heavily in battery projects to complement its growing renewable energy portfolio. Its strategy is vertically integrated, owning battery manufacturer Saft, and is horizontally integrated with renewable assets, positioning itself to offer clean firm power.

ABEE (Avesta Battery & Energy Engineering)

ABEE focuses on covering all aspects of the battery value chain, from R&D and cell production to battery pack systems and recycling. It is establishing a gigafactory in Bulgaria for solid-state battery production and a facility in North Macedonia for Battery Management Systems production.

Q4. What role does the Green Turtle battery park (700 MW) and other large-scale projects play in Belgium’s long-term energy infrastructure, and what are the benefits?

Large-scale energy storage projects like Green Turtle are becoming cornerstones of Belgium’s energy transition. Their key benefits include:

- Grid Stability and Reliability

- Renewable Energy Integration

- Displacement of Fossil Peakers

- Capacity and Resource Adequacy

- Flexibility for Future Needs

Big projects like Green Turtle are strategic assets that bolster grid resilience, enable higher renewable penetration, and reduce reliance on imported fossil energy.

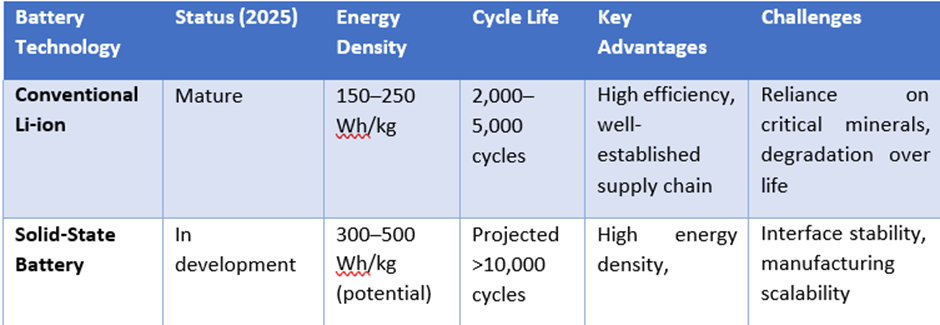

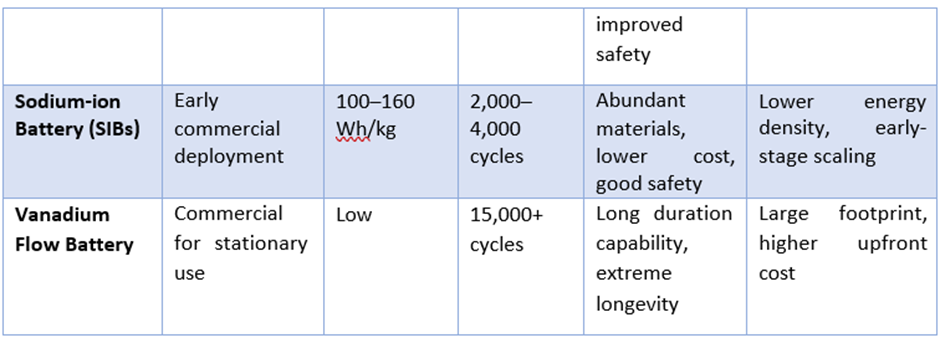

Q5. What are the latest trends in product development within the energy storage sector, including advancements in battery technologies like solid-state or flow batteries?

Solid-State Batteries

These batteries use a solid electrolyte, offering significantly higher energy density, improved safety, and longer cycle life. Commercialization is expected around 2028-2030.

Sodium-ion Batteries (SIBs)

Emerging as a promising alternative to lithium-ion, SIBs use abundant sodium instead of lithium. While they typically offer lower energy density compared to lithium-ion batteries, SIBs promise lower costs, improved safety, and enhanced performance at low temperatures. They are especially attractive for stationary storage and low-cost mobility solutions.

Flow Batteries

These batteries store energy in liquid electrolytes and excel in longevity, making them ideal for long-duration storage. They are particularly suitable for applications requiring heavy cycling and long-term operation.

Comparison Table:

Q6. How is thermal energy storage, as seen in projects like ENERGYNEST at Avery Dennison, evolving as a viable alternative to battery-based storage solutions?

The ENERGYNEST project at Avery Dennison’s plant in Turnhout showcases thermal energy storage as a viable alternative. The project uses concentrated solar thermal collectors to heat a thermal oil fluid, which is then stored in ENERGYNEST’s modular ThermalBattery™. The system can supply 100% of the factory’s heat demand during sunny periods and significantly reduce reliance on natural gas.

Thermal storage is particularly cost-effective for long-duration energy needs where heat, rather than electricity, is the end-use. It complements battery storage by addressing different segments of energy demand.

Q7. If you were an investor looking at companies within the space, what critical question would you pose to their senior management?

Critical Question: What is your long-term strategy to remain profitable and technologically relevant in the face of rapid advancements and competition in the energy storage sector?

This question targets key areas such as technology risk, competitive differentiation, and market adaptability. It helps assess whether a company has a forward-looking, resilient strategy that can sustain profitability and relevance as the energy storage landscape evolves within the current political trend for localization, including the upstream supply chain.

Comments

No comments yet. Be the first to comment!