Sustainability Of Biosimilars Landscape

Democrats are considering helping patients to get best-in-class treatment affordably, and they have taken many considerations such as capping out-of-pocket drug costs for Medicare recipients, paneities on increasing rate faster than the rate of inflation, expanding prescription drug subsidies for low-income seniors, and making vaccines free for seniors. Certainly, it will help patients to get a better life.

But as we know, every action also has some shadow, and from a pharmaceutical industry perspective, we need to think deeper into it.

Biosimilar Adoption

Congress has implemented and encouraged a "competitive market theme" for an industry where they passed Biologics Price Competition and Innovation Act (BPCIA) in 2010.

This has opened up competition for providing affordable and cost-effective solutions to patients and created an abbreviated approval pathway as a way to give the public greater access to biological products that are effective and safe. This strategy has created a challenging environment for Innovators to use defensive strategies to keep their revenue momentum.

And the result of these measures is that today, generics and biosimilars represent nine out of every ten prescriptions dispensed in the United States, and total generic and biosimilar drug savings were about $338 billion in 2020, resulting from 10-year savings by generic medicine is nearly $2.4 trillion.

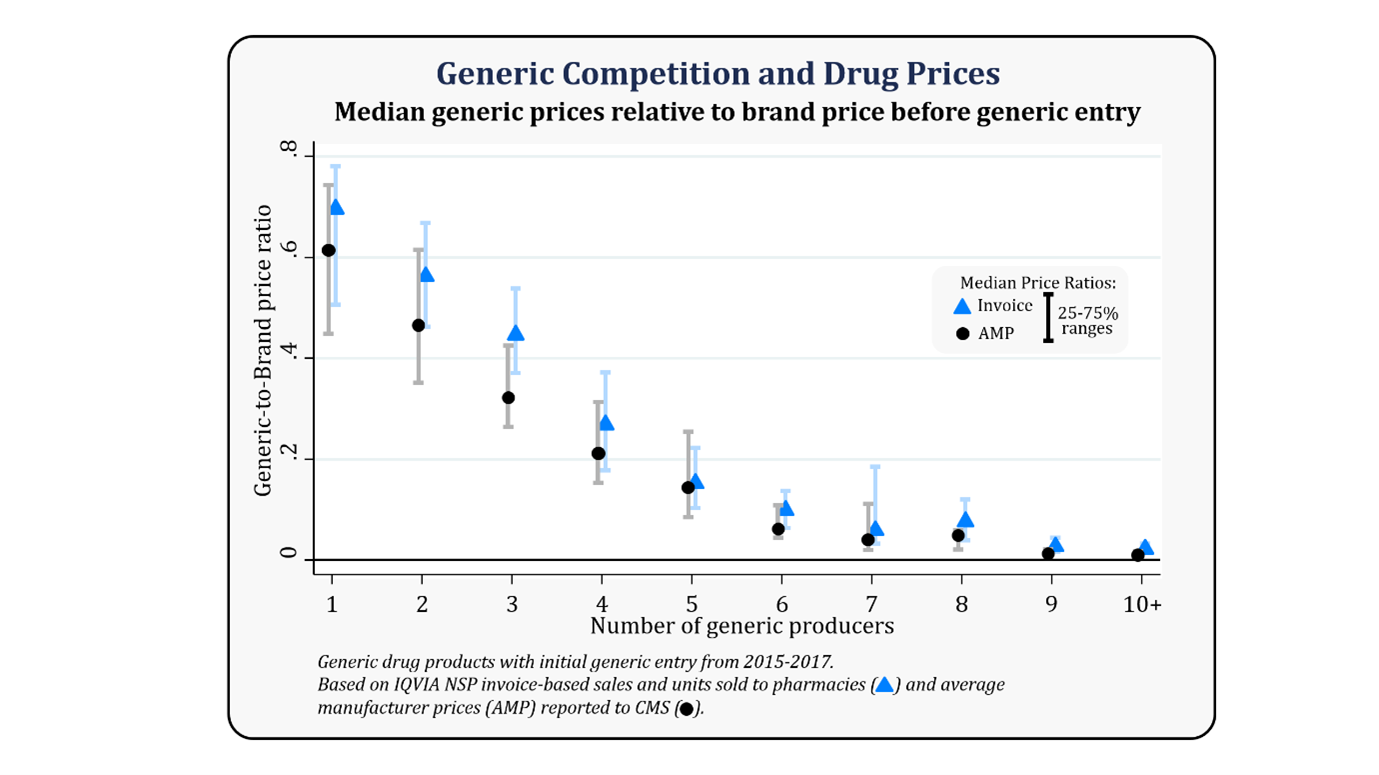

This can be understood from the figure below presented by the FDA as an analysis of prices and competition for all drug products with initial generic entry between 2015 and 2017, showing median generic-to-brand price ratios and their ranges by the number of generic producers.

Further, according to FDA, a greater level of approval of Biosimilars drugs has been seen, which directly speaking that the uptake rate of biosimilars is getting better year on year; hence, BPCIA has proven to balance off the act concerning Industry encouragement, patients’ solution, drug shortage, and creating an ecosystem.

Biosimilars Adoption Challenges

Since Biosimilar’s adoption in the USA has been slow compared to European Union (EMA) in the last decade. It has been seen that biosimilars manufacturers faced a challenging environment to reach a certain minimum level of evidence to break through with some physicians and payers as originator companies often have a wealth of data from years of product use, which they use to defend.

Further, the struggle to beat differentiation strategies of innovators such as value-added services and brand loyalty are added challenges for biosimilars manufacturers.

Build Back Better Theme

Recent progress on bringing the "Build back better" theme is anticipated to reduce the price differences between Biosimilars medicine and innovator medicine which directly discourage the use of biosimilars medicine; hence the pace of biosimilars adoption in the USA is at risk.

For example, as per the discussion in the table, the legislation would cap annual out-of-pocket medication costs for Medicare recipients at $2,000. Beyond this amount, Medicare would pay for the additional expenses, if any.

It would be a significant change since there is currently no cap, meaning people sometimes spend thousands more for a single drug and would be under immense pressure either to increase insurance rates by payers or the industry needs to reduce prices for innovative medicine for better accessibility to patients.

Further, this bill controls innovative medicine pricing by asking refund of the differences to people paying if pharmaceutical companies raise the costs of a drug at a rate faster than the rate of inflation, which means cheaper medications for patients; hence both scenarios suggest a delta of prices between Biosimilars, and innovator would be lower.

These measures not only hamper the pace of Biosimilars adoption in the USA but even, to some extent, discourage efforts towards innovative medicine by Innovators.

For example, Medicare needs to pay for additional expenses coupled with paneities on increasing rate faster than the inflation rate by innovators.

This would directly dampen the pricing power of innovators, which means innovators must absorb inflation and get a hit on their margins which may impact their overall strategy move to use their cash risk-free. Hence may reduce their risk-taking ability to use capital to innovate the medicine, which would directly impact some extent getting next-generation treatment solutions to billions of patients in the future.

At this moment, encouragement and enhanced market competition for generic and biosimilar medicines are needed, which is a clear & proven path for an affordable solution to patients, and drug shortages, and without it, innovator's monopolies could last forever.

This article was contributed by our expert Praveen Gupta

Frequently Asked Questions Answered by Praveen Gupta

Q1. How are biosimilars priced?

Biosimilars are slightly different entities compared to small molecules, where we have seen price reductions up to 80% of originator drugs. Generally, Biosimilars are discounted from 15% to 30% of the Innovator price in a regulated market.

Q2. How much does it cost to bring a biosimilar to market?

Typically, the cost to bring into the market ranges from $100M to $200M in the USA and is about five times lower in India for the regulated market.

Q3. Does Medicare cover biosimilars?

Yes, Medicare covers biosimilars. Biosimilars are treated in a way that provides beneficiaries the greatest choice and protection.

Q4. Which are key factors for the market growth of biosimilars?

The major drivers for the growth of the Biosimilars market are the rising availability of patenting-off of drugs with proven treatment solutions, discounted pricing with similar safe and efficacious drug availability, a government push for combating drug shortage, creating a competitive landscape, clear regulatory expectation and landscape.

In the future, creating awareness among doctors and partners, speed of approvals by regulatory bodies, digitalization in the value chain, COGS reduction, and better pricing will be emerging challenges for manufacturers.

Q5. What pricing strategy do pharmaceutical companies use?

Pricing strategy will be tricky, and modality needs to be assessed and developed. The pricing strategy will be centric to patients’ willingness to pay and consumer surplus. The influencing factors would be the competition scenario for at least three years after launch at the time of entry, regional focus and reach, doctors and partners convincing power, value-added services, and most importantly, during and post-treatment care.

Comments

No comments yet. Be the first to comment!